CKYCR - CENTRAL KYC REGISTRY

CKYCR (Central KYC Registry) is a centralized repository of KYC records of customers in the financial sector. CKYCR will replace the existing multiple KYC submission process while opening savings bank accounts, buying life insurance or investing in mutual fund products into one time centralized process.

The Government of India has authorized the Central Registry of Securitization and Asset Reconstruction and Security interest of India (CERSAI) to manage this Central KYC Registry process. From 1st August, 2016 this new process will be applicable to all individuals.

Salient Features of CKYCR

- It Promotes inter-usability of the KYC records across the sector

- It will reduce burden of getting KYC documents and verification of the same every time

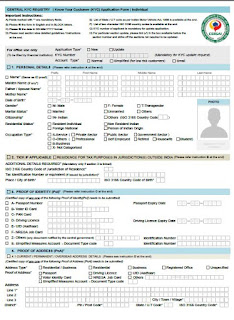

- It is a single form to create or modify CKYC

- It includes the FATCA (Foreign Account Tax Compliance Act) declaration also. Hence, it avoids you to declare the same at the different level of your investments.

- Three types of accounts have been specified in CKYC.

I. Small Investor - If your aggregate of all credits in a financial year does not exceed Rs. 1,00,000, the aggregate of all withdrawals and transfers in a month does not exceed Rs. 10,000/- or the balance at any point of time does not exceed Rs. 50,000/, then you will be considered as Small account type of investor.

II. Simplified or Low-Risk Customers - Customers who are not able to submit anyone document among 6 listed as Passport, Driving License, PAN, Voter ID, Job Card issued by NREGA or Aadhaar Card.

III. Normal - If you will not fall in above two categories of investors like Small or Simplified i.e. Low-Risk Customers, then you have to mention it as Normal customers.

Form for CKYCR can be downloaded from official website of CERSAI (Central Registry of Securitisation Asset Reconstruction and Security Interest of India)

CERSAI assigns a 14 digit KYC Id to every individual which can be used for KYC authentication for that individual across the financial industry.

How To Check KYC Status

Karvy has given a link to Check KYC Status online.

On given link you will get above form to enter PAN and CAPTCHA. Enter PAN and CAPTCHA and click on Search Now. It will display KYC result in tabular format. For newly created Central KYC entry you will get 14 digit CKYC ID.

Some Facts about CKYCR Based on RBI Circulars

purpose of establishment of Central KYC Registry (CKYCR).

- As per the Notification of Central Government dated 07th July 2015, Bank shall file

the electronic copy of the client’s KYC records with the Central KYC Registry

(CKYCR) within 3 days from the date of opening of an account.

-

- The Government of India vide their Notification dated 26th November 2015 authorised the

Central Registry of Securitisation Asset Reconstruction and Security Interest of India

(CERSAI) to act as and to perform the functions of the Central KYC Records Registry

(CKYCR) including receiving, storing, safeguarding and retrieving the KYC records in

digital form.

- The Central Government has also amended the Prevention of Money Laundering

(Maintenance of Records) Rules, 2005 vide Notification dated 07th July 2015 for thepurpose of establishment of Central KYC Registry (CKYCR).

- As per the Notification of Central Government dated 07th July 2015, Bank shall file

the electronic copy of the client’s KYC records with the Central KYC Registry

(CKYCR) within 3 days from the date of opening of an account.

-

Comments

Post a Comment